Living within your means is at the heart of any budgeting crisis. You’ll find this concept coming up between politicians as they try to cobble together a budget to run the country. Because the government is spending more than it takes in means it should either be making cuts or bringing in more revenue. There has never been a 100% agreement on either side of that issue and chances are there never will be. But just because the government can’t get it right doesn’t mean we can use that “living within your means” philosophy to help manage our own lives.

Living within your means is at the heart of any budgeting crisis. You’ll find this concept coming up between politicians as they try to cobble together a budget to run the country. Because the government is spending more than it takes in means it should either be making cuts or bringing in more revenue. There has never been a 100% agreement on either side of that issue and chances are there never will be. But just because the government can’t get it right doesn’t mean we can use that “living within your means” philosophy to help manage our own lives.

Making Cuts

When most people hear that phrase, they immediately jump to the idea of cutting out everything but the bare minimums. That’s not what is being advocated here. There will be the need for some spending cuts but that doesn’t mean doing completely without those things which bring us pleasure. It comes down to a question of defining your priorities. Look, if you had plenty of disposable income this wouldn’t be a problem, but the mere fact that you’re reading this piece means budgeting and finances are an issue. So, let’s roll up the sleeves and get to work.

A Full Accounting

A Full Accounting

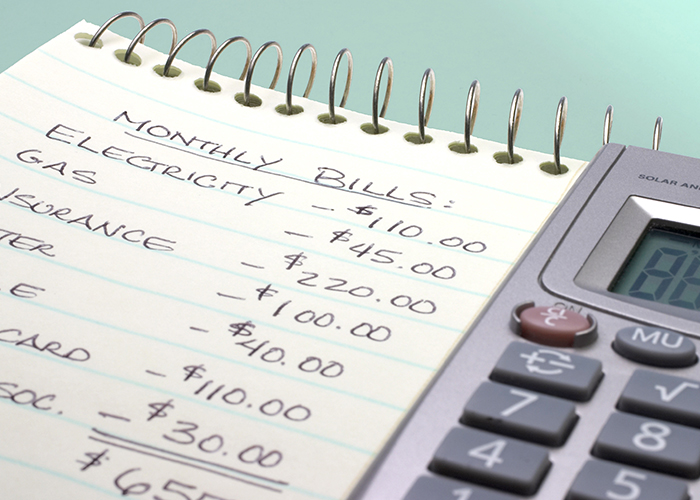

First, you’ll need a complete accounting of what it takes to keep your life running. There are several “hard costs” we can’t avoid such as rent/mortgage, insurance, food and utilities. Those we need to be paying every month. Within those categories there might be some room for cutting. For instance, if you are renting, then ask yourself could you be living somewhere where the rent might not be so expensive? This might be considered a major upheaval, but if you could save even two hundred dollars a month that would represent $2,400 extra dollars in your pocket. What could you do with that? If you are making mortgage payments, then when was the last time you checked on refinancing options? It doesn’t hurt to ask.

Shop Around

As far as insurance, food and utilities you have options there as well. This could be as simple as shopping around, using coupons and turning off lights. In other words, for every hard cost you need to pay out, look for alternatives to help lower those costs.

Doing Without

Doing Without

Next up is the issue of discretionary spending or all the stuff we don’t really need. The best way to approach this issue is to look at the concept of Lent. In the Catholic tradition, Lent is the period of time consisting of the five weeks before Easter. During those five weeks, Catholics are encouraged to give up something they like and with the money they save they should donate to charity. The most popular item to give up is chocolate which is why chocolate Easter bunnies are such a hit! But how much money can you really save by skipping on a couple of Hershey bars?

What you should look at is all those things you could live without for the time being. Into this category would be expensive vacations, eating out four times a week or racing out to buy the latest gizmo. You can find ways to relax which won’t bust your budget. You can eat out just once a week. And you can save up to buy that gizmo, you don’t need to get it on day one when you don’t have the cash.

Living within your means doesn’t have to “hurt;” it just has to be smart.