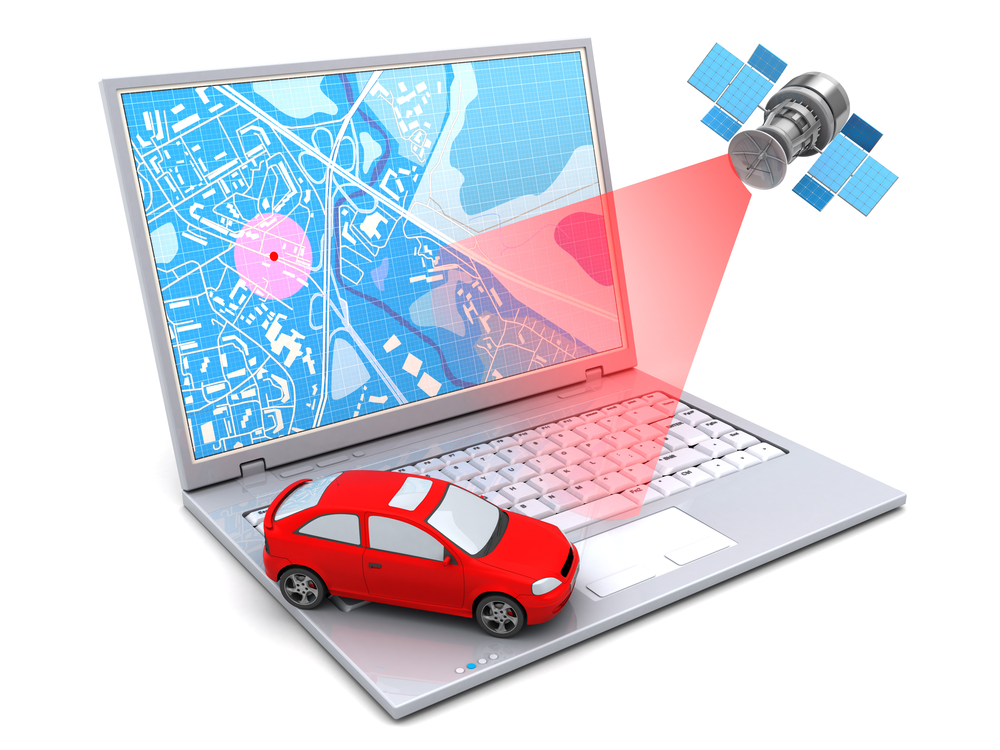

Many insurance companies these days are offering telematics programs as a way to save on premiums. Telematics is a fancy word for “tracking”, and these programs use GPS tracking devices to track things like how far you drive, what time of day you drive, and how well you brake and accelerate.

The idea is that if you’re a safe driver who doesn’t drive too much, you’ll get a discount on your premium. There are a few different ways to take advantage of these programs. First, make sure you understand how the program works and what data the company will be collecting about you.

4. Take Advantage Of Telematics Programs

Join A Usage-Based Insurance Program

Another way to potentially lower your premium is to join a usage-based insurance (UBI) program. With these programs, how much you pay is based on factors such as how far you drive and how often you drive, rather than just your overall driving record. Some UIB programs are rolled into telematics programs however, they may not use the same tracking devices. In this case, they are relying on “scouts honor.”

Pay Your Premium In Full

Most car insurance companies offer a discount if you pay your premium in full. The amount of the discount can vary, but it is typically around 10%. This may not seem like much, but it can add up to significant savings over the course of a year. In addition, paying in full means that you will not have to worry about making monthly payments or incurring late fees. This can help you avoid interest charges and ensure that you always have the coverage you need.

Next Up…. The List of Tips and Tricks To Get Cheap Car Insurance Listed